“Wallet Wars” - The Awakening

Consumer awareness of mobile payment has risen dramatically but adoption rates aren’t as high as many research institutions predicted. At this stage of mobile-first it is now time to move forward with value added services on an aggregated level to make mobile payment SEXY and CONVENIENT.

The current view on the mobile payment ecosystem

Experts identified main challenges for the mobile payments landscape:

- Mobile payment is not a seamless and consistent experience.

- The Pan-European Consortia which aimed to unify the market, failed in its attempts due to a lack of collaboration and strategic alignment cross borders.

- Payment schemes are looking for alternative revenue streams to compensate for their regulated transaction rates and to compete with fintechs entering the market.

- PSD2 (European payment industry regulation) puts pressure on the whole payment market as providers have to open up their environments to standardised conditions.

- Most of the mobile payment services don’t offer sufficient special incentives.

Considering the increasing adoption of mobile wallets such as ApplePay, AndroidPay, SamsungPay, and AliPay - how will other players compete with the growing number of global over-the-top services?

The roadblock of mobile wallets

The lure of something new has universal appeal. Therefore, it’s no surprise that mobile wallet providers spend a lot of resources to attract new consumers. But even for big brands, acceptance is growing slowly, mainly due to the diversity of offerings. Low merchant acceptance rates result in consumer mistrust. Mobile wallets don´t come with a lot of consumer friendly features in general, beyond the initial cool factor or the ability to save time at the till. If it’s urgent that consumers adapt their behaviour, you must come up with a game changing relevant experience.

Sweet spot for merchant services

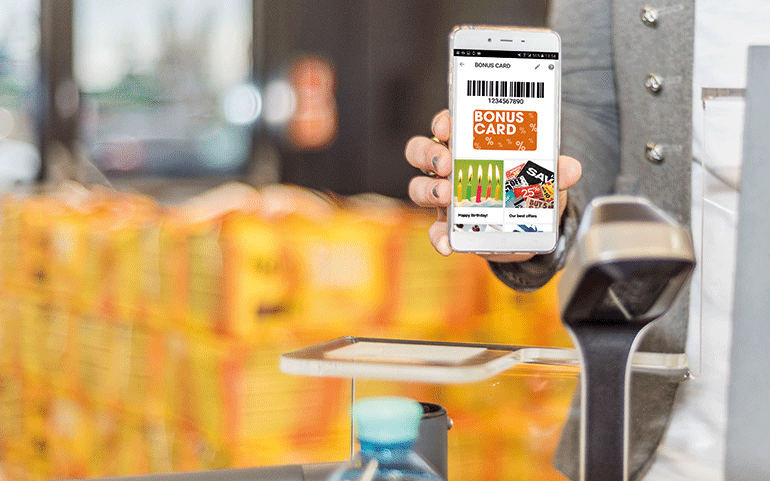

Loyalty programmes and couponing are at the heart of many merchants’ customer engagement strategies. Advanced mobile technologies and services are opening up opportunities to make loyalty and couponing more relevant and compelling for consumers.

In-store, merchants use mobile contactless technologies, such as GPS and Beacons for location aware interactions to influence consumers in a shopping situation (when presenting the loyalty card or pushing relevant, personalized content, for example). Moreover, merchants and brands can use mobile technologies and services to increase the effectiveness of their marketing campaigns in real-time.

It’s obvious that each and every brand and merchant tries to have its very own app out in the market. As consumers interact with many different merchants and brands, it is unrealistic for business owners to expect that all individual B2C apps will be consumed equally. Today, consumers expect to find all shopping benefits in one relevant place. This is where the acceptance of mobile wallets comes in.

How to survive the “Wallet Wars”?

Consumer centric user experience is the basic groundwork of the only useful but daunting KPI: Retention Rate. Merchants and brands seek deeper and stronger relationships with consumers to enable cross-selling and to up-sell their portfolio. Meanwhile a 2017 consumer expects consistent experience across all sales channels and touchpoints from the brands they love.

Mobile wallets will play a key role in connecting brands and consumers and enabling a seamless shopping experience. People today have clearly expressed their desire for a single wallet that keeps track of all of their loyalty memberships and coupons, and automatically applies earned rewards.

A well designed wallet is meant to:

- enable a compelling mobile shopping customer experience

- help merchants attract new customer and serve loyal pre-existing customers

- generate the necessary scale across the whole value chain.

In 2017, things appear to be shifting again in the “Wallet Wars”: Besides device manufacturers Apple, Google and Samsung, it seems that only wallets that provide value-added services will survive.

May the force be with you!

Mobile payment alone is no game changer anymore. The strong demand for a value-adding ecosystem addressing consumer and merchant needs has become the No 1. market topic.

The mobile-pocket loyalty HUB is built to enrich the loyalty services baseline in a wallet. The services start from a very basic but relevant functionality of storing loyalty cards, towards more advanced capabilities of targeting and engaging with consumers on an individual level.

While enabling merchant and brand communications functionality, the HUB ensures adoption and active users, increases relevance, pushes transaction frequency, offers higher reach over the HUB ecosystem and maintains consumer happiness.

Merchants and brands are given a single entry point to conveniently manage content across the globe in multiple wallets. This results in astonishing consumer satisfaction, which makes the hard work of wallet operators to entertain consumers worth it. Improvement of app ratings (in avg. by 0,7 Stars), proven boost of usage and exciting additional interaction points for consumers mark a tipping point in wallet experience to meet the standards of the 2020´s.

The industry-disrupting open ecosystem approach from mobile-pocket is bringing true value to all partnering

stakeholders with a fair share. Banks, MNOs, brands, merchants, franchisees, shop owners and end users benefit equally.

Best practice case of a mobile wallet

A remarkable case can be found in the Vodafone Group. The international team has achieved their best practice, and were honoured with several global awards in the past months. Scoring “Emerging Payments Award for the Best Loyalty Incentive Programme” and two trophies for the “Payments Award with the Engagement & Loyalty Scheme of the Year 2016” clearly sets a global benchmark. Vodafone, with the mobile-pocket HUB as enabling service, managed to increase traction and improved core KPIs such as consumer adoption, user activity, app and service ratings on a remarkable base.

Partner up to create force

mobile-pocket HUB is recognized by industry leaders as an enabling solution for rapid mobile wallet growth. It is now up to you to join this award-winning ecosystem approach and sustainably survive the “Wallet Wars”.

More posts

Digital Loyalty on the rise

The turn of the year is the most important time for retailers as it comes to the highest generated revenues and the highest number of client contacts.

The Final Countdown - Breakthrough of Mobile Wallets

It is not known how many transactions are processed digitally worldwide. But new offers are making customers more aware of mobile payments.